Audit & Assurance

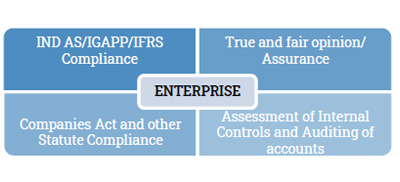

The foundation of the service we deliver is based on adherence to values and delivering value to the client. We have expertise in the application of audit methodology and techniques and use it to bring precision and value to your audit.

- Further, we address audit requirements and challenges through:

- Complete compliance with laws & regulations

- Advice on controls and processing system weaknesses

- Confirmation of accounting treatment with respect to complex transactions

- Monitoring of regulatory changes and the consequent prospective accounting

Internal Audit

Internal Audit evaluates a company's internal controls, including its corporate governance, accounting processes, compliance with laws and accurate and timely financial reporting. It helps in optimising operational efficiency and in identifying problems and mitigating them before they do serious damage or are discovered subsequently in an external audit.

Statutory Audit

Statutory Audit is a legally required review of the accuracy of a company's financial statements and records. The purpose of a statutory audit is the same as the purpose of any other type of audit: to determine whether an organization is providing a fair and accurate representation of its financial position by examining information such as bank balances, bookkeeping records and financial transactions.

- The Companies Act, 2013 mandates every Company to undergo for statutory audit irrespective of its sales turnover, nature of business or capital deployed.

- Limited Liability Partnership (LLP) shall get its account audited if it crosses a turnover Rs. 40 Lakhs annually or has capital contribution more than 25 Lakhs.

- The Statutory Audit of Banks is mandatory and, the RBI in association with the ICAI appoints Statutory Auditors for the same. At the end of every financial year, a rigorous statutory audit is conducted in every branch of a bank.

Financial Audit

Companies prepare financial statements that provide information about their financial position and performance. This information is used by a wide range of stakeholders in making economic decisions. Therefore, the owners of these companies (as well as other stakeholders, such as banks, suppliers and customers) take comfort from an independent assurance that the financial statements fairly present, in all material respects, the company's financial position and performance.

It involves steps such as checking the accuracy and correctness if the transactions, effectiveness of controls, physical reconciliation, inspection etc